Top Mistakes Businesses Make When Choosing an EPOS Provider

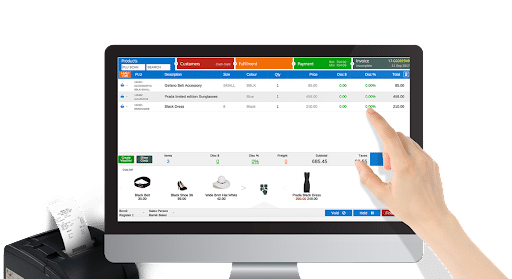

An Electronic Point of Sale (EPOS) system is necessary for all types of businesses to process transactions effectively. Its two main components, the hardware and software, not only handle transactions but also support other functions like managing inventory, tracking customer data and updating cloud-based transactions across different locations.

But with so many providers available in the market, it’s easy to focus on surface-level features without digging deeper into the advanced functions. Unfortunately, this often leads to choosing an EPOS system that fails to meet the business’s daily needs. Today, we’ll cover five of the most common mistakes businesses make when choosing an EPOS provider and how you can avoid them to find the right solution for your business.

1.Choosing based on price alone

If you’re a small business on a budget, choosing the cheapest EPOS system might seem like the right choice. However, low prices often come at the expense of functionality, long-term reliability, or decent customer support. In some cases, providers pose hidden costs, usage limitations, or additional fees to balance out their lower upfront charges.

Instead of looking for the lowest prices, look at what the system offers, including its ease of use, the quality of customer support, transparency of the provider, and overall reliability of the system. To understand how EPOS systems are typically priced, check out the latest guide & comparison on EPOS systems prices.

2.Not considering your business type

Different types of businesses operate in their unique ways, which means each one requires a specific system to match its workflow. One of the most common mistakes is choosing a type of EPOS system without considering how well it fits your daily business needs.

For example, a terminal EPOS system used by a retail store may not be suitable for a restaurant or a beauty salon. That is because restaurants typically require features like tipping options, bill splitting and table-side payments, which are better met by a mobile EPOS system. Always look for a provider that offers solutions based on your specific business industry.

3.Not fully understanding the contract terms

Rushing into signing up with an EPOS provider without fully understanding the contract terms can lead to unpleasant surprises later on. You could find yourself stuck in a long-term agreement with early termination fees or penalties for switching providers. In some cases, providers also put additional charges for installation, support, regular maintenance, or software updates in fine print. To avoid this, ask for a full breakdown of the EPOS costs and take the time to read the contract carefully.

4.Overlooking customer support quality

Many businesses make the mistake of choosing an EPOS provider without evaluating the quality or responsiveness of their support team. The availability of customer support impacts the business’s workflow in case of a service issue or if you need technical help. Quick response times lead to effective solutions and help minimise the downtime of your system.

Before signing a contract, find out if support is available 24/7, whether it’s live chat, phone-based based or through email. Also, check customer reviews to get an actual idea of how helpful the provider is in meeting consumer demands.

5.Failing to plan for future growth

Many businesses choose an EPOS system based only on what they need right now, without considering future plans. This often results in them outgrowing the system too soon or being forced to switch providers before the contract ends.

To avoid such disruptions, start by identifying which features your business is likely to rely on in the long term. Those features could be smooth card transactions, cloud-based backup, usage flexibility or scalability. Then match those priorities with a provider that offers a balance of affordability and performance. ComparedBusiness UK can help you compare top EPOS providers to make the decision-making process easier. That way, you get your deserved value for money by investing in a system that meets your needs in the long run.