Want to Trade Banking Stocks in 2025? Follow These Steps!

The banking sector is once again commanding attention in 2025, both in India and globally. Following a challenging 2024, the banking sector has staged a solid comeback, driven by healthier loan books, accelerated credit growth, and growing investor optimism. But with opportunity comes the need for caution. If you’re looking to trade banking stocks in 2025, this comprehensive guide will help you identify high-potential opportunities while managing risk with confidence.

1. Understand the Structure of the Banking Sector

Before taking a position, it’s essential to grasp how the Indian banking ecosystem is structured. Broadly, banks are classified into:

Public Sector Banks (PSBs), such as Canara Bank, State Bank of India, and Bank of Baroda, are where the government holds a majority stake. Private Sector Banks, like HDFC Bank, ICICI Bank, and Axis Bank, are known for their operational efficiency and digital adoption. Small Finance Banks and Cooperative Banks cater to niche segments or rural areas.

Each segment responds differently to regulatory changes, economic cycles, and monetary policies. For example, public sector banks often benefit from government-led reforms and recapitalisation plans, while private banks may outperform during periods of stable interest rates and robust credit growth.

2. Track the Right Financial Metrics

To trade banking stocks intelligently, you must look beyond the share price and dive into fundamental indicators. Key metrics to monitor include:

Net Interest Margin (NIM): Measures the profitability of a bank’s lending. A higher NIM reflects efficient lending operations.

Gross & Net NPAs (Non-Performing Assets): These indicate the quality of a bank’s loan book. A decline in NPA ratios is a clear indicator of improving asset quality and financial stability.

CASA Ratio (Current and Savings Account): A higher CASA ratio implies access to low-cost deposits, which boosts margins.

Provision Coverage Ratio: Reflects how much capital a bank has set aside to cover potential losses from bad loans.

For example, if the Canara Bank share price rises following a strong quarterly report showing improved NIM and a fall in NPAs, that may signal a positive trend worth trading.

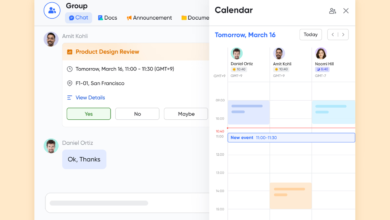

3. Use a Reliable Screener for Research

With dozens of listed banking stocks, narrowing down your options is critical. A screener helps you apply filters based on profitability, valuation, asset quality, and more.

For example, if you’re looking for mid-cap public banks with improving asset quality and attractive P/B ratios, a screener for stock market can instantly shortlist potential candidates.

4. Build a Trading Plan with Strong Risk Management

A well-structured trading plan is essential for success in the banking sector. Here’s what it should include:

Define Clear Entry and Exit Strategies

Use technical indicators such as moving averages, chart patterns, and support/resistance zones to determine precise buy and sell points. Avoid making impulsive decisions based on emotions or market noise.

Diversify Your Positions

Instead of putting all your capital into one or two stocks, consider spreading your trades across a few fundamentally strong banking stocks. This reduces exposure to company-specific risks and smoothens overall performance.

Use Stop-loss Orders Effectively

Incorporating stop-loss orders into your trading plan allows you to manage risk proactively and maintain consistency, even in volatile markets.

5. Stay Updated with Sector News and Earnings Announcements

Banking stocks are sensitive to macroeconomic developments and regulatory changes. Traders should stay informed through:

- RBI Monetary Policy Announcements: Interest rate changes directly impact bank margins and credit demand.

- Union Budget and Fiscal Updates: Especially those that affect public sector bank recapitalisation or infra spending.

- Quarterly Results: Focus on loan growth, net profit, provisions, and commentary from the bank’s management.

Conclusion

Trading banking stocks in 2025 can be both rewarding and challenging. With renewed investor interest, strong sector fundamentals, and evolving market dynamics, opportunities are plentiful, but so are the risks.

By understanding the structure of the sector, using the right tools like Screeners, tracking financial and technical indicators, and managing your risk wisely, you can make smarter, more confident trading decisions.