The Importance of Compliância in Modern Business Practices

Understanding Compliância Definition and Key Principles

Compliance, in the context of modern business practices, refers to the adherence to laws, regulations, guidelines, and specifications relevant to business operations. It signifies a company’s commitment to operate within the legal boundaries established by governmental authorities while also following industry best practices. Compliância ensures businesses function ethically, mitigate risks, and contribute to a fair marketplace.

The concept of compliance is multifaceted, incorporating both mandatory regulations and voluntary standards. Mandatory regulations, or laws, are legally binding rules established by governmental bodies. Companies must adhere to these laws to avoid legal penalties, fines, and other sanctions. Examples include tax laws, employment laws, and health and safety regulations. Non-compliance with these laws can lead to severe consequences, including financial losses and reputational damage.

Voluntary compliance standards, on the other hand, encompass industry best practices that are not legally binding but are adopted by companies to enhance performance, build trust, and foster sustainable business practices. These standards often reflect the collective wisdom of industry leaders and stakeholders, providing guidelines aimed at promoting excellence, innovation, and ethical conduct. Adopting voluntary standards, such as ISO certifications and environmental guidelines, allows companies to demonstrate their commitment to high standards and continuous improvement.

Key principles of Compliância include transparency, accountability, and ethical business conduct. Transparency involves clear, open communication about business practices, policies, and decisions. This principle ensures stakeholders are well-informed and fosters trust between a company and its clients, partners, and regulatory bodies. Accountability means holding individuals and the organization as a whole responsible for their actions, ensuring there are mechanisms in place to monitor compliance and address non-conformance. Ethical business conduct involves consistently applying moral principles, such as fairness and integrity, in all business interactions and decisions, thereby promoting a culture of honesty and respect.

The Impact of Compliância on Business Operations

In today’s regulatory landscape, compliance has become a critical focal point for businesses across all sectors. The importance of maintaining a robust compliance program cannot be overstated, as it directly affects various aspects of business operations. A well-implemented compliance framework serves as the bedrock for organizational integrity, mitigating potential risks while fostering operational efficiency and customer trust.

One of the most significant impacts of compliance is the avoidance of legal penalties. Non-compliance can invoke severe legal repercussions, including hefty fines, sanctions, and even criminal charges against company executives. For instance, the Volkswagen emissions scandal is a high-profile example, where non-compliance with environmental regulations led to billions of dollars in penalties and a severely tarnished reputation. Such examples underscore the catastrophic consequences of Compliância failures.

Financial losses are another substantial risk associated with non-compliance. Beyond fines and legal costs, companies may also face revenue dips, heightened scrutiny from investors, and side effects on stock performance. In the case of Enron, violations of accounting regulations culminated in one of the largest bankruptcies in history, showcasing how non-compliance can erode financial stability and precipitate organizational collapse.

The impact on reputation cannot be ignored either. A firm’s reputation takes years to build but can be demolished almost overnight due to compliance breaches. Public trust is vital for customer retention and brand loyalty. Compliance failures, as seen in the Wells Fargo fraudulent account scandal, result in lost customer trust, leading to long-term detrimental effects on business sustainability and market position.

Conversely, stringent adherence to Compliância standards can confer multiple benefits. It can streamline operational processes, leading to higher efficiency and reduced operational risks. Routine audits and adherence to regulatory requirements ensure that business processes remain optimized and transparent. Furthermore, a strong compliance culture can enhance customer trust, assuring clients that the organization prioritizes ethical practices and regulatory integrity.

Ultimately, the importance of compliance in modern business practices is evident through its far-reaching impacts on legal standing, financial health, operational efficiency, and customer trust. By prioritizing compliance, businesses not only safeguard themselves against multifaceted risks but also pave the way for sustained growth and market confidence.

Developing an Effective Compliância Program

Creating a comprehensive compliance program is pivotal for ensuring adherence to regulatory requirements and promoting ethical business practices. The first step in this process is conducting a thorough risk assessment. By identifying potential Compliância risks specific to an organization’s operations, it becomes possible to tailor policies and procedures to mitigate these risks effectively.

Establishing clear and concise policies and procedures forms the backbone of a robust compliance program. These documents should outline the expected behaviors and operational standards within the organization. It’s vital that these policies are easily accessible and regularly updated to reflect any changes in regulatory landscapes or organizational structures.

Employee training is another critical component. Regular training sessions help ensure that all employees are aware of compliance requirements and understand their roles in maintaining compliance standards. Training should cover not only regulatory requirements but also the ethical values and principles that the organization upholds.

Continuous monitoring and auditing are essential for maintaining an effective Compliância program. Implementing ongoing monitoring mechanisms allows for the identification of potential compliance issues before they escalate. Regular audits, whether internal or external, help verify that policies and procedures are being followed and that compliance risks are being managed appropriately.

Appointing a dedicated Compliância officer can significantly enhance the effectiveness of a compliance program. This individual is responsible for overseeing all compliance-related activities, ensuring adherence to legal and ethical standards, and acting as a point of contact for any compliance concerns or queries.

Building a culture of compliance within an organization is also crucial. Leadership must model compliant behavior and emphasize the importance of compliance in all business operations. Encouraging open communication about Compliância issues can help foster an environment where employees feel comfortable reporting concerns without fear of retaliation.

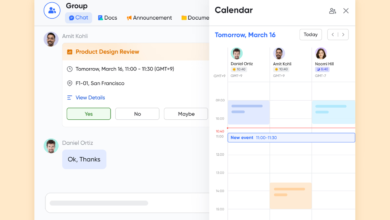

Technology plays a vital role in managing compliance requirements and tracking Compliância metrics. Utilizing compliance management software can streamline the process of monitoring regulatory changes, maintaining records, and generating compliance reports. Technology enables organizations to stay up-to-date with compliance obligations and ensures a thorough and organized approach to managing compliance.

Future Trends in Compliância

The compliance landscape is rapidly evolving, driven by technological advancements and changing regulatory frameworks. Businesses must stay attuned to these future trends to ensure adherence to compliance standards without compromising efficiency. One significant trend is the increasing role of technology in enhancing Compliância processes. Artificial intelligence (AI) and blockchain are poised to transform how companies handle compliance. AI can automate complex compliance tasks, such as monitoring transactions and detecting anomalies, thereby reducing the risk of human error. Blockchain, with its decentralized and immutable ledger, promises to offer transparency and accountability, crucial for maintaining compliance in financial and data transactions.

Additionally, the implementation and enforcement of data privacy regulations, exemplified by the General Data Protection Regulation (GDPR) in the European Union, are becoming more pervasive globally. These regulations impose stringent requirements on how businesses collect, store, and manage personal data, compelling organizations to prioritize data privacy in their operations. Failure to comply with these regulations can result in substantial financial penalties and damage to reputation. Therefore, businesses must invest in robust data management systems and continuously train their staff on data privacy best practices.

Globalization further complicates the Compliância landscape. As companies expand their operations across borders, they encounter varied regulatory environments. Navigating these diverse requirements necessitates a comprehensive understanding of local laws and an adaptable compliance strategy. To prepare for these challenges, businesses should establish a centralized compliance framework that allows for the integration of local regulations. Leveraging technology to streamline this integration can help ensure consistency and efficiency in compliance efforts.

Looking ahead, compliance challenges will likely continue to evolve. The rise of digital transactions and remote work arrangements, expedited by the COVID-19 pandemic, adds new dimensions to compliance. Companies must remain proactive, continuously assessing their Compliância frameworks and adopting innovative solutions to address emerging risks. By staying ahead of these trends, businesses can not only avoid regulatory pitfalls but also build trust with stakeholders and maintain a competitive edge in the market.