Regulations and Compliance in the World of Digital Payments

The ways we move money are more different today than in the previous century and the past ten years. With smartphones in our pockets and digital wallets taking over from cash, our payments have become speedier, more convenient, and global. But as financial technology has evolved, so have the risks — fraud, data breaches, and money laundering are just a few threats that have cropped up alongside innovation. As a result, regulation and compliance have emerged as critical pillars in the digital payment ecosystem to protect users and build trust in the system.

Payment Solutions: Powering Safe and Scalable Growth

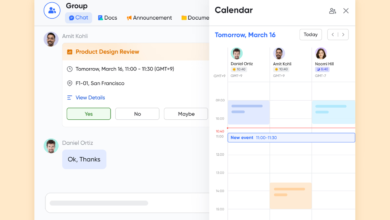

In business transactions, B2B payment solutions have stepped up as a critical enabler of safe, efficient, and scalable growth. Unlike consumer-facing payment apps, B2B systems are built to handle large volumes, complex billing cycles, and cross-border transfers. What makes these solutions even more vital is their focus on compliance and risk management. By embedding secure processes, automatic fraud detection, and real-time monitoring, B2B payment platforms help companies stay compliant while keeping transactions smooth. In turn, this trust and efficiency ripple out into the broader tech economy, enabling startups and enterprises alike to operate globally without compromising security. When B2B payments are safe and compliant, innovation can thrive without fearing financial disruption.

The Role of Regulation: Creating Trust in a Digital World

Underpinning every trusted digital transaction is a web of rules to safeguard money and keep businesses honest. Intermediary regulations such as the Payment Services Directive (PSD2) in Europe and the Electronic Fund Transfer Act (EFTA) in the United States define the parameters for processing and protecting digital payments. These laws aren’t just a form of bureaucratic red tape — they help prevent financial crimes, promote transparency, and level the playing field between fintech companies and traditional banks. Without them, digital payments would become a free-for-all, and trust, arguably the most important currency of all, would evaporate.

Compliance Challenges: Navigating an Evolving Landscape

Even with solid regulations in place, staying compliant is far from simple. The digital payment world is constantly changing, and so are the rules. Fintech companies must navigate anti-money laundering (AML) laws, know-your-customer (KYC) requirements, data privacy regulations like GDPR, and country-specific compliance demands. It’s a moving target. One misstep can lead to fines, damaged reputation, or even being shut down. That’s why many companies are turning to “RegTech”—technology designed specifically to simplify and automate compliance. Tools that use AI and machine learning to monitor transactions in real-time are now essential to staying ahead of hackers and regulators.

Globalization and Cross-Border Regulation

The urgency of global cooperation around compliance increases as payments become borderless. A deal that originates in Singapore travels through a European bank and ends up in a U.S. account must adhere to multiple regulatory regimes. This can result in friction, hold-ups, or contradictory rules. In order to streamline this complexity, international organizations such as the Financial Action Task Force (FATF) are attempting to unify compliance standards. Although strides are certainly being made, consensus on a worldwide level remains a work in progress. But the payoffs — easier international trade, safer remittances, and greater financial inclusion — are worth the effort.

Looking Ahead: Innovation Within the Rules

The future of digital payments has many possibilities: decentralized finance, blockchain technology, biometrics, you name it. However, there is no solution for these innovations without a robust compliance backbone. The companies that will flourish in the next wave of fintech won’t only be the most innovative; they’ll be the most trustworthy. In some respects, compliance should be viewed not as an impediment but as a partner in innovation. Digital payment solution providers must embrace regulation to build transformative, innovative platforms that are trustworthy, responsible, and inclusive.

As the digital payment landscape evolves, even cryptocurrencies like Dogecoin are gaining traction, and understanding dogecoin price movements is essential for businesses looking to navigate this space. Platforms like Moonpay are making it easier for consumers to buy cryptocurrency seamlessly while staying compliant with financial regulations, ensuring a smooth and secure transaction experience.

The Balance Between Progress and Protection

Amid the blistering speed of digital payments, regulation, and compliance are not just required but lie at the heart of sustainable growth. The road ahead isn’t always clear, but achieving the right balance between innovation and oversight will help define the future of finance. For both consumers and businesses, this balance brings safer, more transparent, and more empowering money movements around the world.