What Are A2A Payments? A Simple Guide for Businesses

Digital payments have evolved fast. One term you might see more often now is A2A payments, which means account-to-account payments. But what are they, and why are they gaining popularity in eCommerce?

This guide breaks down what A2A payments are, how they work, and why more businesses are starting to adopt them.

What Are A2A Payments?

As we mentioned earlier, A2A stands for account-to-account payments. It’s a direct money transfer between two bank accounts without cards or wallet balances involved.

You may think – what’s the difference then between A2A and simply manual bank transfers? The answer is that A2A payments aren’t manual. They are automated through technology such as open banking.

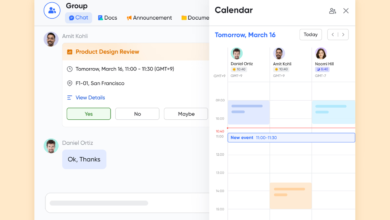

In the open-banking scenario, the customer simply chooses an “pay-by-bank” option, and then authorises their payment via the banking app. The money is sent from their account directly to the merchant account. No effort is needed from the customer – the UX is smooth. That’s the magic of A2A.

How Do A2A Payments Work?

We’ve explained this a little bit above, but let’s take a look at the step-by-step process In simple terms:

- The customer selects “pay from bank” at checkout.

- They log into their bank or approve the payment through their banking app.

- The funds are transferred directly to the business’s bank account.

- Both sides get confirmation.

That’s it. No card numbers (or high card fees!), no delays, and no intermediaries holding funds.

Open Banking: Technology Behind A2A

A2A payments existed before open banking but were difficult to implement in e-commerce. That changed with the introduction of open banking, which enabled businesses to offer A2A payments directly on their websites and apps—bypassing card networks.

Open banking was introduced in Europe in 2018 under PSD2, which required major banks to provide licensed providers access to customer data and APIs. This created a wave of innovation, leading to efficient fintech products like pay-by-bank A2A payments.

Benefits of A2A Payments

More businesses are exploring A2A because it’s simple and efficient. Here’s why it matters:

- Lower fees: A2A payments skip card networks. That means fewer transaction fees and no interchange charges. This reduces the cost burden significantly for a merchant!

- Instant settlement: In many cases, funds arrive in seconds. That’s great for cash flow and reduces the need for short-term borrowing.

- Better security: Open banking payments are based on bank-level APIs, and can only be implemented by providers licensed by a regulatory body such as FCA. Plus, customers authenticate through their bank. Data is transferred via APIs rather than screen-scraping. There’s no need to store card data, which reduces fraud and PCI compliance burden.

- No chargebacks: Because payments are verified and authorised by the payer, A2A payments eliminate traditional chargebacks.

- Mobile-friendly: Since A2A works through banking apps, it fits perfectly with how customers already manage their money on mobile.

Common Use Cases for A2A Payments

You can find A2A payments in many industries. Here are a few practical examples:

A2A payments are gaining traction across a range of industries. Here are a few practical examples:

- eCommerce: One of the most visible use cases. Pay-by-bank is increasingly offered at checkout as a streamlined alternative to card payments, reducing friction and lowering transaction costs.

- Travel and ticketing: Particularly effective for high-value purchases, where avoiding card fees can make a significant difference for both customers and merchants.

- Real estate: A secure and traceable way to transfer large sums, such as rent or deposits, often preferred over manual bank transfers.

- B2B payments: Enables faster, lower-cost settlement between partners, with better reconciliation compared to traditional methods like wire transfers.

How A2A Payments Compare to Other Methods

| Feature | A2A Payments | Card Payments | Wallets |

| Fees | Low | Medium to high | Medium |

| Speed | Instant (in many cases) | 1–3 business days | Instant |

| Chargebacks | No | Yes | Sometimes |

| Customer Experience | Seamless (via bank app) | Familiar but slower | App-based |

| Risk of Fraud | Low (bank-authenticated) | Medium | Low to medium |

How to Accept A2A Payments as a Business

Getting started is easier than you might think:

- Choose an open banking provider that supports A2A payments via pay-by-bank

- Integrate the solution into your website or app.

- Test the payment flow.

- Add A2A as a visible option at checkout.

- Explain the benefits to your customers (e.g. faster, safer, no card needed).

Many providers offer plug-and-play options with no code required.

Things to Consider when Integrating A2A

Bank Coverage

Open banking coverage varies widely by country, and even by bank. Some regions have near-complete access to major banks, while others are still catching up.

It’s worth checking not just how many banks are supported, but also which ones. If your customer base skews toward certain banks, make sure those are reliably integrated and well-tested.

Customer Trust

While A2A and open banking are growing fast, it’s still unfamiliar to many people, especially less to non-digitally native generations. Users may hesitate if the process feels new or unclear.

The way you present it matters: simple, transparent language like “pay directly from your bank” can help. So can a short visual guide or embedded FAQ at checkout. Trust builds through clarity, not just logos and badges.

Refunds

A2A doesn’t follow the same rails as card networks, so there’s no built-in refund mechanism. That doesn’t mean refunds are impossible, just that you’ll need a plan.

Some providers offer API-based refunds, others leave it to you to initiate a new payment back to the customer. For high-volume merchants, automating this can save serious time and avoid support bottlenecks.

Reporting

Reconciliation can be one of the trickiest parts of any payment system. Look for a provider that offers clear, real-time reporting and insights, not just raw data, but readable dashboards with filters, statuses, and export options. Bonus points if they offer alerts for failed or pending payments, so your team can act fast when needed.

Why A2A Payments Are Growing in Popularity

A2A payments aren’t just a trend. They’re part of a bigger shift in how we move money:

- Open banking regulation has unlocked secure access to bank accounts.

- Consumer habits are shifting away from cards.

- Merchants want lower costs and more control.

- Developers prefer APIs for flexibility and automation.

Together, these forces make A2A payments an attractive option.

Final Thoughts

So, what are A2A payments? In short, they’re a faster, cheaper, and safer way to move money directly between bank accounts, built on open banking technology.

For businesses, A2A unlocks big benefits: fewer fees, faster settlement, and lower fraud risk. For customers, it’s simple, familiar, and secure. As more people get comfortable with open banking, A2A payments will likely become a core part of online and in-store checkout. If you’re not offering it yet, now is a great time to explore your options and start testing.