Property Market Trends to Watch in 2025

As we look ahead to 2025, the UK property market is set to undergo significant changes driven by economic conditions, government policies, technological advancements, and evolving buyer preferences. Whether you’re a homeowner, investor, or first-time buyer, understanding these trends can help you make informed decisions, according to property experts like local Estate Agents in Basingstoke.

Here are the key property market trends to watch in 2025.

Economic Factors Interest Rates and Inflation

The direction of interest rates and inflation will play a crucial role in shaping the property market in 2025. The economic landscape has been volatile in recent years, with rising inflation and fluctuating interest rates impacting affordability and demand.

Stabilising or Lowering Interest Rates

Throughout 2023 and 2024, the Bank of England increased interest rates to combat inflation. However, by 2025, interest rates are expected to stabilise or decrease as inflation comes under control. Lower rates could lead to better mortgage conditions, encouraging buyers to enter the market and increasing demand.

- Impact on Buyers: Lower interest rates would improve affordability, particularly for first-time buyers and those looking to move up the property ladder.

- Impact on Sellers: With more buyers able to secure mortgages, demand for homes is likely to rise, potentially driving up prices in desirable areas.

Inflation and Cost of Living Concerns

Although inflation is expected to stabilise, the lingering effects on the cost of living could influence buyer behaviour. Households may continue to be cautious about spending, which could lead to a more price-sensitive market.

Rise in Energy-Efficient and Eco-Friendly Homes

The government’s ongoing push towards Net Zero by 2050 is set to influence the property market. Buyers are becoming more conscious of energy efficiency, not only for environmental reasons but also to reduce rising energy costs.

Focus on EPC Ratings

By 2025, the UK government is expected to introduce tighter regulations regarding Energy Performance Certificate (EPC) ratings. Homes with higher EPC ratings (A or B) will be more desirable, while properties with lower ratings could see reduced demand unless upgraded.

- Impact on Sellers: Sellers with energy-efficient homes can expect increased buyer interest, as these properties offer lower utility bills and future-proofing against stricter regulations.

- Impact on Buyers: Buyers are likely to prioritise energy-efficient homes due to both cost-saving benefits and anticipated regulatory changes, leading to greater competition for properties with high EPC ratings.

Increased Adoption of PropTech and Digital Tools

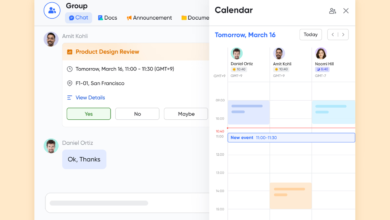

The property market is rapidly embracing PropTech (property technology) to improve efficiency and transparency. By 2025, digital tools are expected to be more prevalent across the buying and selling process.

Virtual Viewings and Digital Marketplaces

Virtual reality (VR) and 3D property tours became popular during the COVID-19 pandemic, and their use is expected to continue growing. These technologies allow buyers to view properties remotely and save time.

- Impact on Sellers: Properties marketed with high-quality virtual tours may attract more interest, particularly from international buyers or those relocating from other regions.

- Impact on Buyers: Virtual viewings offer greater convenience and flexibility, enabling buyers to narrow down their choices before attending physical viewings.

Blockchain and Smart Contracts

Blockchain technology is set to streamline property transactions through smart contracts. These self-executing contracts can reduce paperwork, eliminate intermediaries, and speed up the buying and selling process.

- Impact on Transactions: Faster and more secure transactions using blockchain could become the norm, improving transparency and reducing the risk of fraud.

Shift in Buyer Preferences: Remote Working and Flexible Living

The rise of remote and hybrid working is reshaping buyer preferences, with many people looking for homes that offer flexibility in terms of space and location. This trend, accelerated by the pandemic, is likely to continue shaping the market in 2025.

Demand for Home Offices and Outdoor Spaces

As remote working remains popular, buyers are prioritising homes with dedicated office spaces or flexible rooms that can serve as work areas. Additionally, the importance of outdoor space has grown, with gardens, terraces, and balconies in high demand.

- Impact on Sellers: Homes with spare rooms that can be converted into offices, or properties with well-maintained gardens and outdoor areas, will likely attract more interest.

- Impact on Buyers: Buyers are expected to continue seeking homes that offer a better work-life balance, including properties with versatile spaces and easy access to nature.

Migration to Suburban and Rural Areas

The trend of moving away from dense urban centres to more spacious suburban and rural areas is expected to continue. With remote work allowing greater flexibility, more buyers are choosing homes with larger living spaces and a better quality of life outside city centres.

- Impact on Urban Markets: While major cities will remain desirable, areas with good transport links and proximity to green spaces will likely see increased demand.

- Impact on Suburban and Rural Markets: As more buyers seek homes in quieter areas, suburban and rural markets could experience faster price growth, particularly in regions with improved infrastructure and amenities.

Conclusion

In 2025, the UK property market will likely be affected by the interaction of economic climate, government policies, technology, and changes in buyer preferences and requirements. Interest rates stabilised at this point and will start to strictly adhere to energy efficiency needs. Then, buyers and sellers will have no option but to change their trends and priorities.

For homeowners and investors, the trends with careful considerations on proper property renovations, digitalization, or expansion to new markets will navigate a changeable future for properties in 2025.