Decoding Hugo Bachega Accent A Blend of Brazilian Roots and Global Reporting

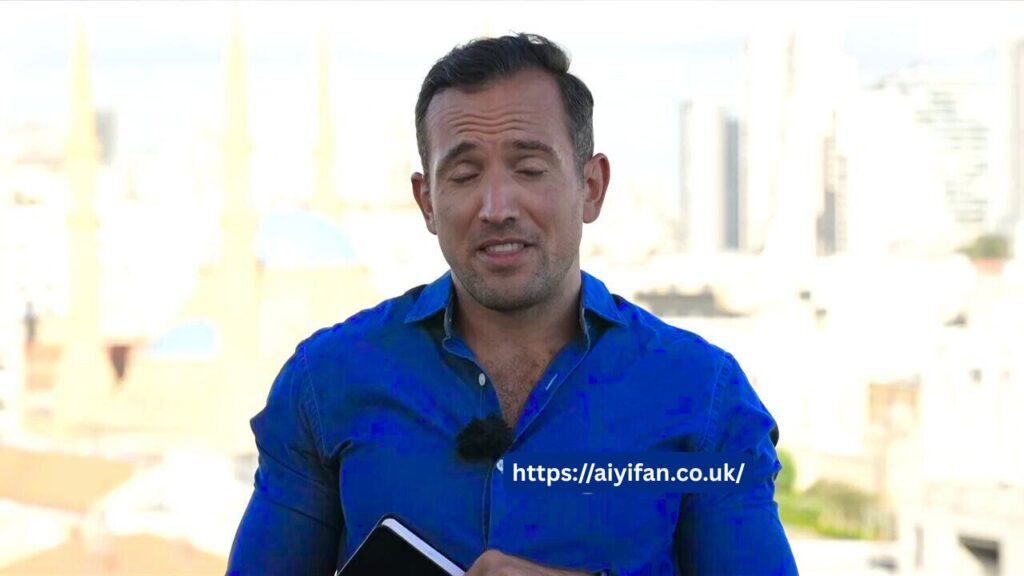

Hugo Bachega is a name that resonates with viewers of global news, especially those who follow the BBC. As a seasoned journalist and foreign correspondent, Bachega has built a reputation for his incisive reporting and calm, articulate presence on screen. However, one element about him that often piques public curiosity is his distinctive accent. It is a fascinating vocal signature that doesn’t fit neatly into one box and reflects a life lived across cultures, languages, and continents. In this article, we explore the roots, evolution, and uniqueness of Hugo Bachega accent tracing it back to his Brazilian heritage and its transformation through his international career.

Brazilian Beginnings The Foundation of Bachega’s Accent

Hugo Bachega Accent was born and raised in Brazil, a country known for its linguistic diversity, colorful culture, and rich history. The primary language spoken in Brazil is Portuguese, and Bachega is a native speaker. Brazilian Portuguese has its own unique sound, distinct from the European variant, with melodic intonations and regional variations that shape a person’s manner of speaking from a young age.

Bachega’s accent is initially rooted in this linguistic landscape. Depending on his specific regional background within Brazil for instance, whether he grew up in Rio de Janeiro, São Paulo, or another area the tonal quality and rhythm of his early Portuguese speech would have been shaped accordingly. This foundation set the stage for the accent we hear today.

Education and Early Career Exposure to English

As Bachega began his journey into journalism, English quickly became an essential part of his professional toolkit. For many international reporters, English is the lingua franca of global news, and mastering it is a key to unlocking international opportunities.

Whether through formal education or on-the-ground experience, Bachega developed fluency in English. His command of the language is clear in his reporting, where he articulates complex geopolitical events with clarity and confidence. During this period, his accent began to take on a hybrid character. While his Brazilian roots remained evident, the immersion into English-speaking environments introduced new phonetic influences.

BBC and the Global Stage The Accent Evolves

Joining the BBC marked a pivotal moment in Hugo Bachega’s career. The British Broadcasting Corporation, with its vast global audience and high editorial standards, not only elevated his profile but also further shaped his accent. Working alongside British and international colleagues likely refined his English pronunciation, subtly aligning it more closely with British English while maintaining his unique vocal identity.

At this stage, Bachega’s accent became what many now recognize as a neutral yet slightly Latin-tinged English. It’s an accent that defies easy categorization: not quite British, not distinctly American, and yet not heavily Brazilian either. This indeterminate quality makes it both intriguing and accessible to a global audience.

Why His Accent Matters Representation and Accessibility

In an industry where standardized speech has historically dominated, Bachega’s accent represents a shift toward more inclusive and diverse voices in media. His presence on international news platforms like the BBC signals that expertise and authenticity can come with a range of vocal expressions.

Audiences around the world increasingly resonate with reporters who sound like them or who reflect a broader human experience. Bachega’s accent, shaped by his Brazilian upbringing and international experience, offers a relatable and refreshing alternative to the traditional “Queen’s English” often associated with British broadcasting.

Moreover, his clear and precise speech serves as a model for non-native English speakers who aspire to work in global media. He demonstrates that it is possible to maintain one’s linguistic identity while achieving fluency and professionalism in a second language.

The Phonetic Nuances What Makes It Unique?

From a phonetic perspective, Bachega’s accent includes several interesting features. Listeners may notice:

- Slightly rolled or softened “r” sounds typical of Portuguese influence.

- A rhythmic cadence in his speech that reflects the musicality of Brazilian Portuguese.

- The occasional stress placement that hints at his native language structure.

Yet, his English vocabulary, intonation, and syntax are near-native, which adds to the seamlessness of his delivery. This balance between native and learned linguistic elements gives his speech a distinctive yet polished sound.

Multilingualism and Cognitive Flexibility

Bachega’s accent is also a testament to the cognitive flexibility that comes with multilingualism. Speaking multiple languages enhances brain function, improves the ability to multitask, and heightens cultural sensitivity qualities essential for a foreign correspondent.

As someone who likely operates in Portuguese, English, and possibly other languages (such as Spanish or French), Bachega embodies the global citizen. His accent is a natural outcome of this multilingual, multicultural experience. It serves as a subtle reminder that our voices carry the imprint of our journeys.

Audience Perception A Global Appeal

Viewer comments on social media and discussion forums often mention Hugo Bachega’s accent. Many express admiration for its smoothness and clarity, while others try to guess its origin. This curiosity underscores the accent’s uniqueness and the global appeal it brings.

For international audiences, a “neutral” accent like Bachega’s is easy to understand, especially for non-native English speakers. This enhances his effectiveness as a communicator and adds to the credibility of his reporting. It also fosters a connection with diverse viewers who see him as a reflection of their own multilingual realities.

Conclusion

Hugo Bachega accent is more than just a way of speaking. It is a symbol of his personal and professional journey from Brazil to the world stage. It encapsulates his identity as a journalist who bridges cultures, languages, and perspectives. In a time when authenticity and global representation matter more than ever, Bachega’s voice resonates not just for what it says, but for what it represents.

By embracing and celebrating accents like his, the media world moves closer to a more inclusive and authentic reflection of the global audience it serves. Whether you’re tuning in from London, São Paulo, Nairobi, or New York, Hugo Bachega’s reporting and his distinctive voice offer a powerful reminder of journalism’s evolving, multicultural landscape.